Prem Shah, EVP, Pres-Pharm, Consumer W at CVS Health Corp (NYSE:CVS) sold 29,473 shares of the company’s stock on February 16, 2024, according to a recent SEC filing. The trades were executed at an average price of $76.95 per share, for a total value of $2,268,502.35.

CVS Health Corp is a health care innovation company dedicated to helping people on their path to better health. The company operates a unique combination of businesses, including pharmacy benefits managers, a national pharmacy network, and long-term care pharmacies, complemented by medical benefits and community-based health services. CVS Health Corp serves an estimated 38 million people across healthcare sectors.

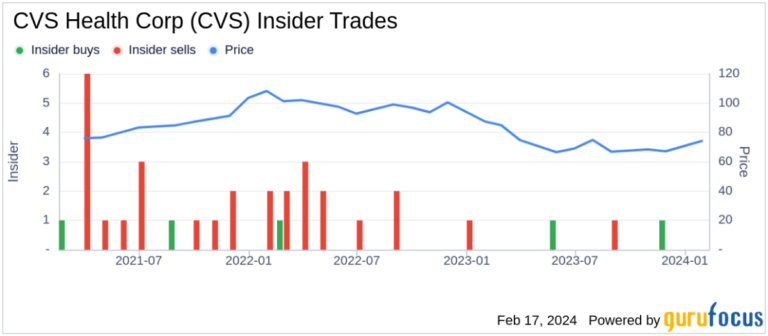

Over the past year, insiders have sold a total of 29,473 shares, but bought no shares. The recent sale by Prem Shah represents a continuation of this sale trend.

CVS Health Corp’s insider trading history shows balanced activity by insiders. There were 2 insider buys and 2 insider sells in the past year.

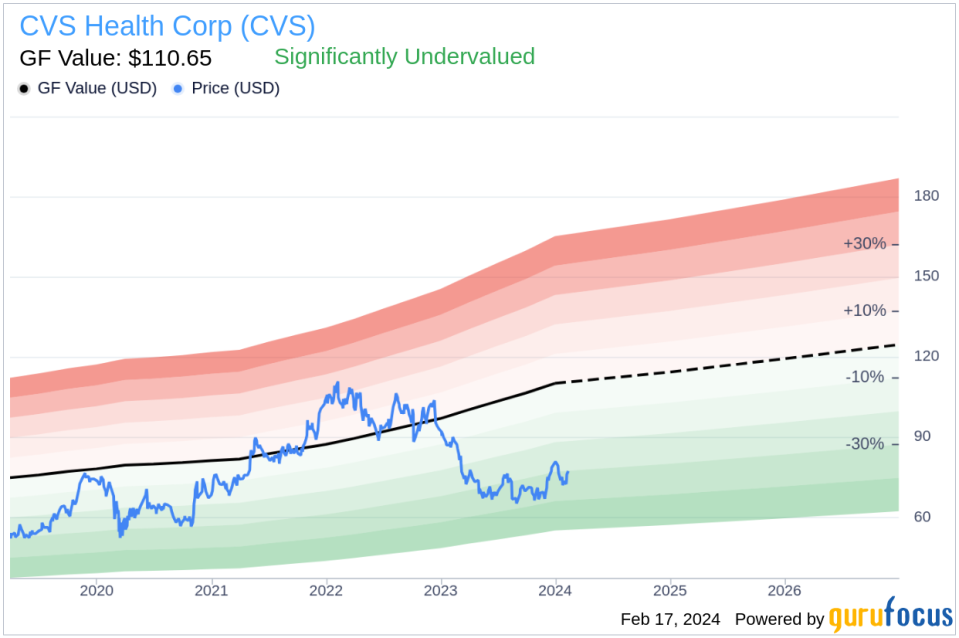

In terms of valuation, CVS Health Corp’s stock was trading at $76.95 on the day of the insider sale, giving the company a market capitalization of $97.03 billion. His price-to-earnings ratio of 11.93 is lower than the industry median of 18.36, and is also lower than the company’s historical median price-to-earnings ratio.

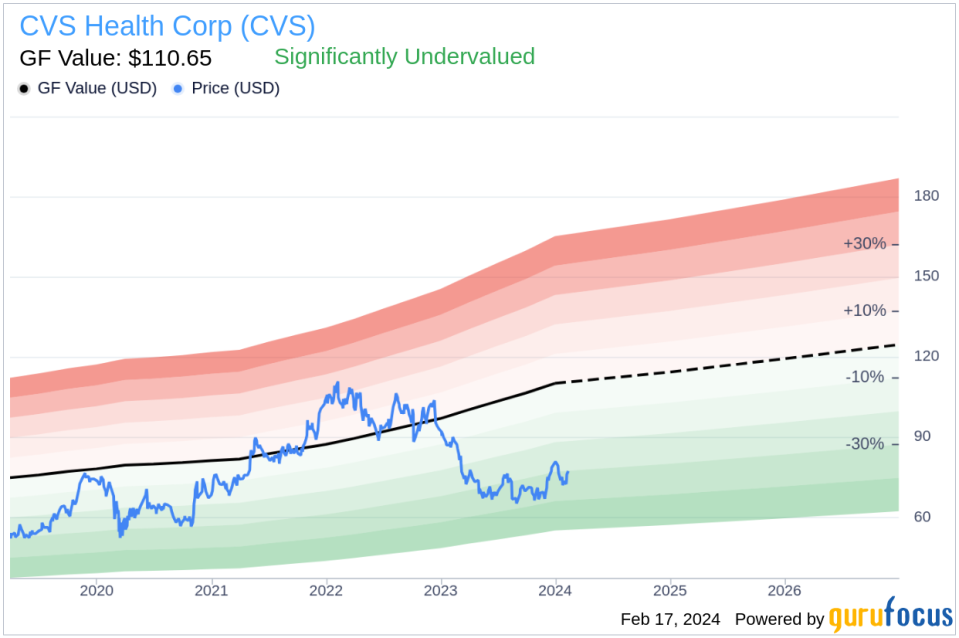

The Price to GF Value ratio is 0.7 and the GF Value is $110.65, indicating that CVS Health Corp is significantly undervalued according to GuruFocus’ intrinsic value estimates. GF Value is calculated based on historical trading multiples, GuruFocus adjustment factors, and Morningstar analyst estimates of future performance.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.