Central Bank has advanced internal innovation and an IT team that enables banks to control and evolve their customer experience. Adding Personaletics’ AI platform will enable central banks to enhance and accelerate time to market and provide hyper-personalized cash management guidance and experiences on par with hyper-regional and national banks. . Importantly, the platform allows central banks to proactively answer questions that their customers never thought to ask, a key advantage in promoting financial health.

“Providing great digital experiences is essential to fostering healthy economic growth in our communities.” Daniel Westhughes, Executive Vice President and CMO of the Central Bank. “Using this AI-driven platform from Personatics, we can better understand the unique needs of each of our customers and empower them with personalized financial insights and proactive advice tailored to them. We can lead positively.”

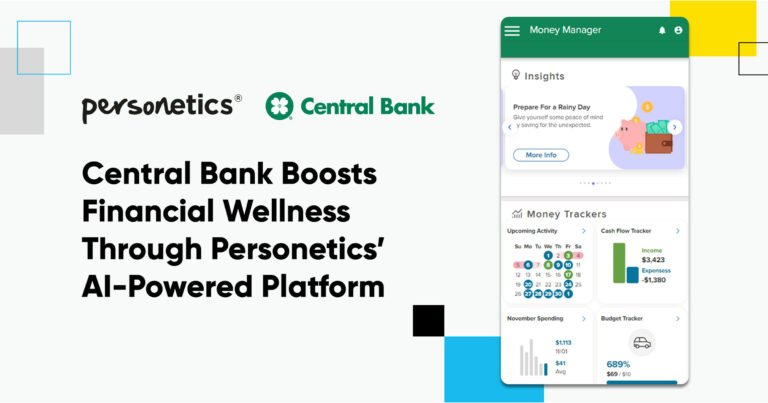

Central Bank digitally transforms traditional services by moving to on-cloud implementation, delivering intelligent persona-powered dashboards, goals-based savings experience, and personalized money advice to digital users . The solution includes integrated customer account aggregation that enables central banks to compete in the open banking era.

The main features are:

- A reimagined money management hub that replaces outdated budgeting tools

- Smart savings and wellness programs tailored to your personal goals

- Contextual, real-time guidance and advice based on cash flow analysis

- Get a consolidated view of all your internal and external customer accounts to provide comprehensive, real-time advice.

“Community banks know their customers’ financial lives intimately, but until now they have lacked the technology to truly personalize the customer experience,” he said. Jodi Bhagat, President of Personatics in the Americas. “Our AI-powered platform will enable local and community banks to offer a customized digital money experience that rivals national banks.”

PERSONETICS’ powerful financial data-driven personalization engine enables central banks to offer their customers comprehensive financial analysis, recommendations, and wellness programs that are typically only available to the largest institutions.

The central bank is hosting a co-branded webinar with Personaletics. March 28th Learn how advanced AI enables highly personalized customer service and financial health guidance.sign up click here.

About central banks

Founded in 1902, Central Bank is a community bank serving customers in 140 locations throughout the Midwest. The central bank is committed to creating a working environment based on trust, respect and respect for differences. The bank offers a comprehensive suite of personal and business banking solutions delivered through its digital channels and branch network. missouri, Kansas, illinois, oklahoma, colorado and florida. For more information, please visit: www.centralbank.com.

About Persona

Personaletics is a global leader in financial data-driven personalization, enabling financial institutions to build deeper relationships by improving customer financial health and helping customers make smarter decisions. Personaletics serves 135 million customers in 35 markets worldwide, serving over 140 financial institutions. PERSONETICS’ AI analyzes financial data in real-time to understand customer financial behavior and anticipate needs, delivering daily actionable insights, personalized recommendations, product-based financial advice, and automated financial wellness programs. Deliver a hyper-personalized experience.The company has offices at new york, London, SingaporeSão Paulo, tel aviv. For more information, please visit: www.personetics.com.

Photo – https://mma.prnewswire.com/media/2373382/Personaletics.jpg

Source personality theory